Unpacking the Wealth Tax Proposal

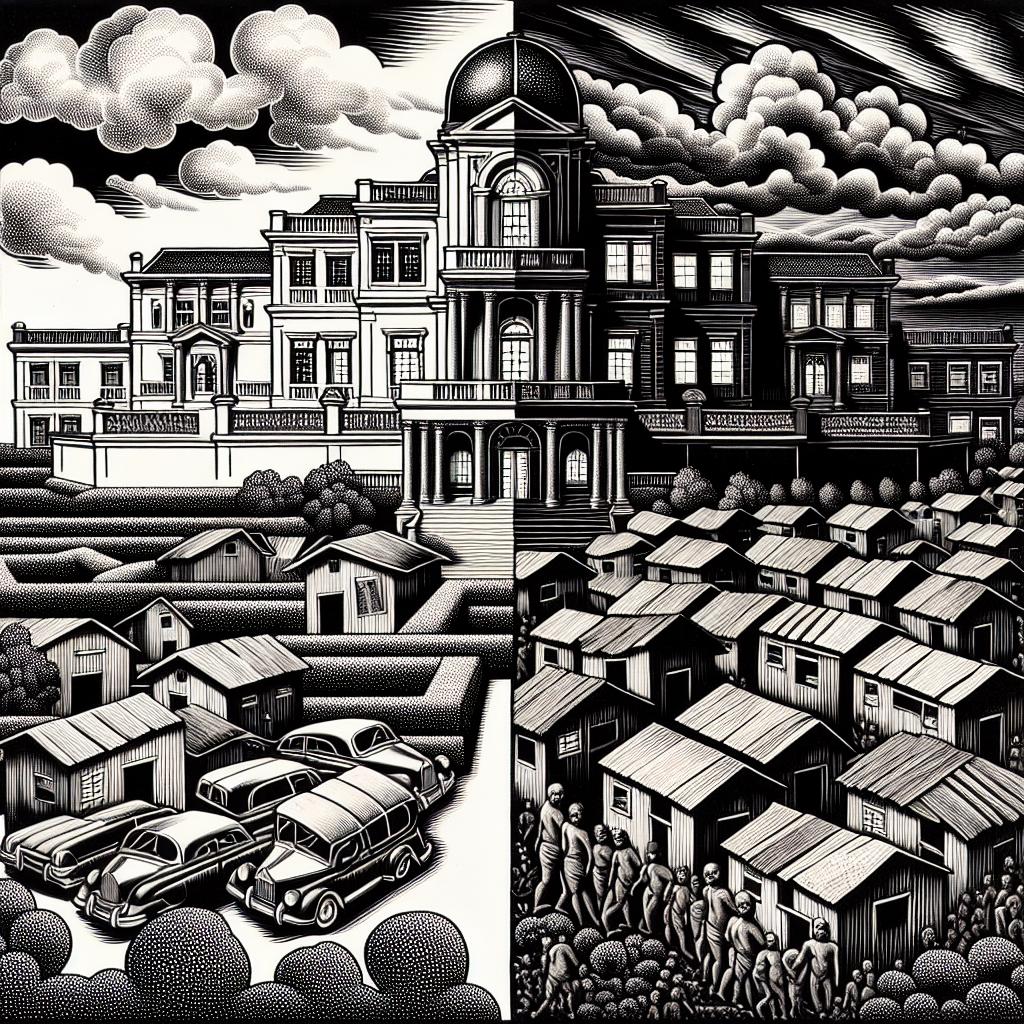

In the midst of escalating discussions about income inequality, the concept of a wealth tax has emerged as a focal point in policy debates. This idea, gaining traction particularly among those advocating for social justice, aims to levy taxes based on an individual’s net worth rather than their income alone. Proponents suggest that a well-defined wealth tax can be an effective tool for addressing income disparities and funding critical social programs that benefit society as a whole.

In a nation where wealth accumulation is often concentrated among a small elite, how can a wealth tax not only level the playing field but also empower economic fairness?

Supporters of the wealth tax highlight that one of its main benefits is potential redistribution of resources. By taxing those with considerable wealth, the argument goes, the funds can be directed towards societal programs that serve wider populations—think education, healthcare, and infrastructure. These investments, in turn, could stimulate the economy in ways income-centric taxation may not.

In essence, proponents hope to encumber the ultra-wealthy—an elite demographic believed to wield outsized influence over economic policies and political agendas—with responsibilities that reflect their financial capabilities. This proposal, they argue, is not merely about raising revenue; it’s relatively about creating a fairer economic landscape.

The Arguments For and Against

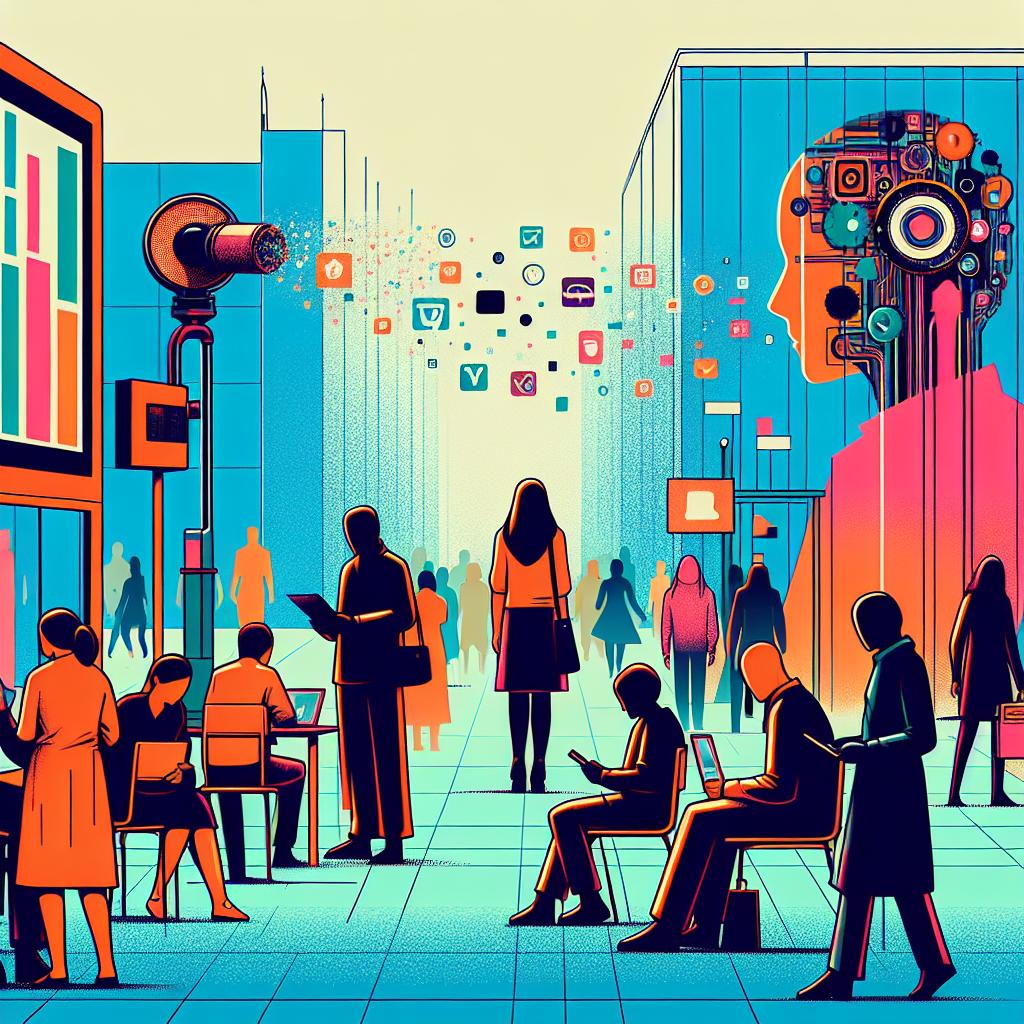

The wealth tax tends to ignite fierce debate. On one side, advocates assert that such a tax could mitigate the vast power held by billionaires and the stranglehold they often maintain on the political system. “By levying taxes on wealth instead of income, we can start dismantling the barriers that allow a handful of individuals to dictate our economy,” economist Sally Thompson argues.

However, as all things in economics often reveal, not everyone sees a wealth tax in a positive light. Critics argue that imposing steep taxes on wealth could deter investment; if millionaires and billionaires face significant financial penalties for accumulating wealth, they may choose to relocate (with their businesses and investments) to countries with more favorable tax laws.

Moreover, legal challenges are anticipated if the wealth tax moves into implementation. Opponents argue that it may conflict with constitutional principles regarding property rights. Thus, while the intention of the wealth tax seems to positively align with social equity, its execution may wind up bogged down in a mire of legal complexities.

https://img-h0ster.s3.us-west-2.amazonaws.com/civicmag/316_content.jpg

Exploring the Broader Impacts

As the discussion continues, it’s crucial to examine how such a policy could reshape both the economy and society. What would it mean for American businesses? Would it drive innovation, as tax revenues are funneled into social programs? Or might it also trigger a withdrawal of investment by the richest citizens, who claim that additional taxes diminish their financially risky behaviors that can lead to economic growth.

The tension here embodies a larger philosophical question of how to define progress: Is it measured by the accumulation of wealth for a few or by improved quality of life for the many? The idea of fairness weighs heavily in the balance as various groups share their perspectives on this pivotal issue.

As we move forward into the 21st century, perhaps one thing is clear; achieving economic justice will require a definitive rethinking of policies governing wealth and equity. The wealth tax argument continues to spark vital discourse on how to fairly finance essential services while stimulating parts of the economy typically sidelined.

The discussion transcends just the notion of taxation—it deals fundamentally with our values as a society. As we contemplate the implications around a wealth tax, let us take into consideration not just the fiscal aspects but the ethos surrounding wealth distribution and what it stands to mean for our collective future.

In the end, the wealth tax may serve as a testing ground for a broader re-evaluation of economic justice in America, revealing how serious our commitment really is to creating a fairer society for all.

As we closely observe the developments in this debate, one thing hangs in the balance: the possibility that new wealth tax provisions could usher in an era of greater equity that echoes throughout the fabric of society.

This article illustrates the wealth tax debate as just one prism through which larger societal issues like economic inequity and fairness are viewed, reminiscent of broader conflicts in politics today.